schedule c tax form example

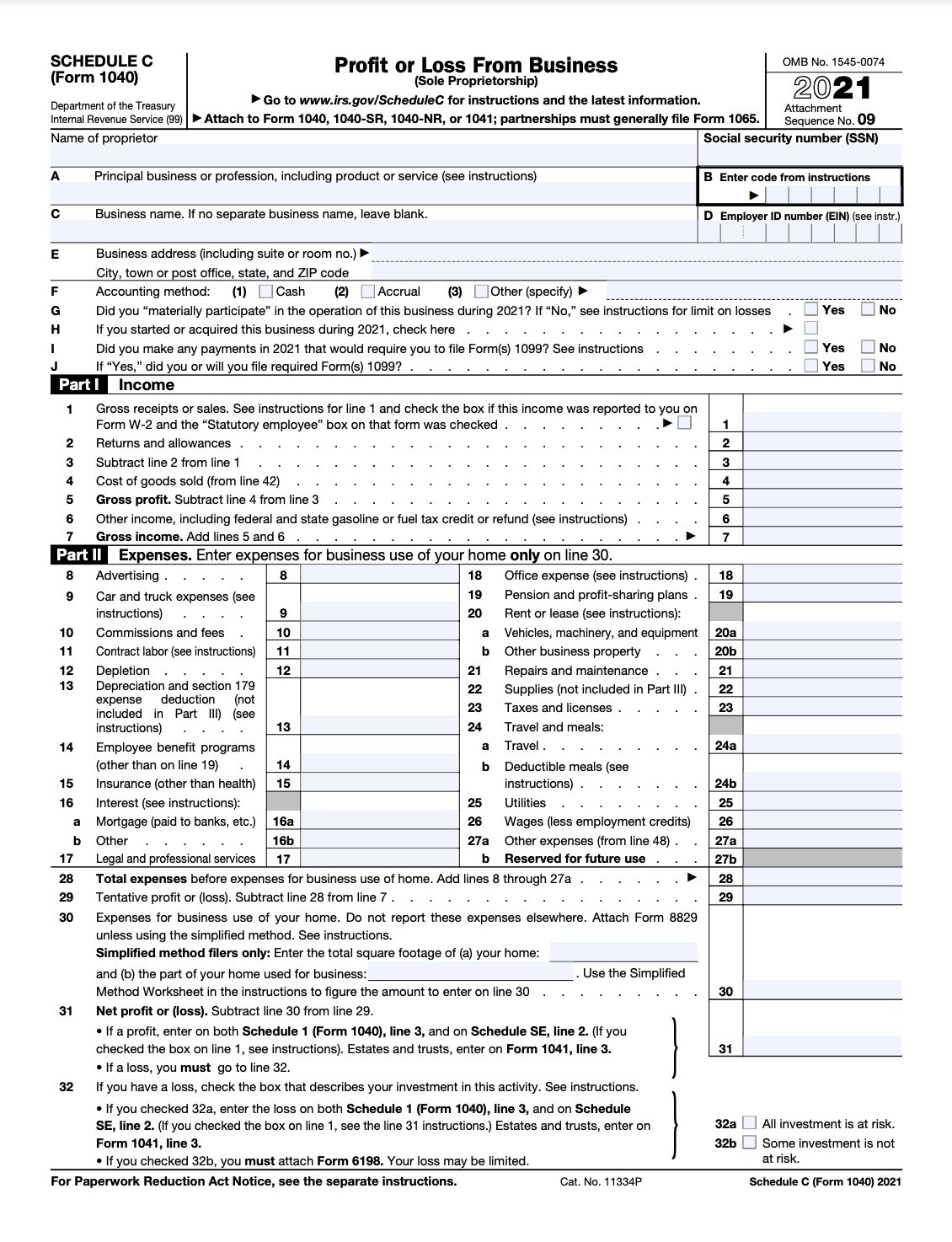

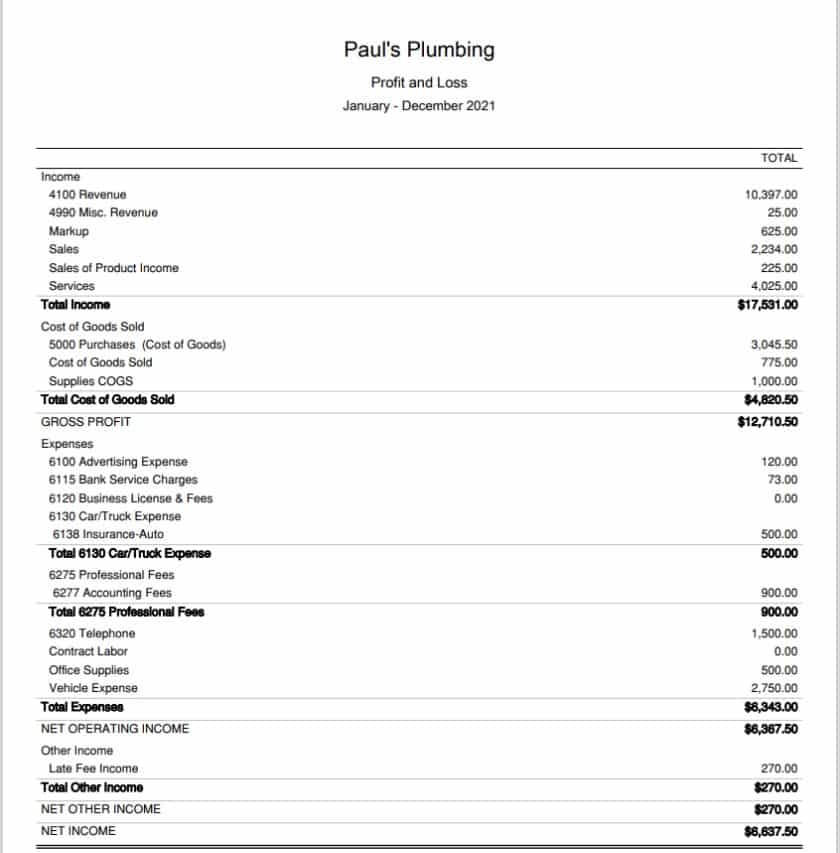

IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business. Frank Carter is a sole proprietor who owns and operates a fishing boat.

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Steps to Completing Schedule C Step 1.

. Schedule C has two columns that need to be examined. Deductible on Schedule C Form 1040. So for our Schedule C walkthrough were going to look at how Bruce Banner also known as The Hulk would complete his tax form.

A bakery owner whos about to be audited by the IRS for incor- rectly categorizing and deducting business expenses on Schedule C Form 1040. 100000 Cost of Goods Sold COGS. This is where Schedule C starts to look less straightforward and more like a tax form.

Joshs Swim Business Simple Schedule C Gross income 101000 Returns and allowances 1000 Total Income. These forms essentially serve two purposes. The first is to help you.

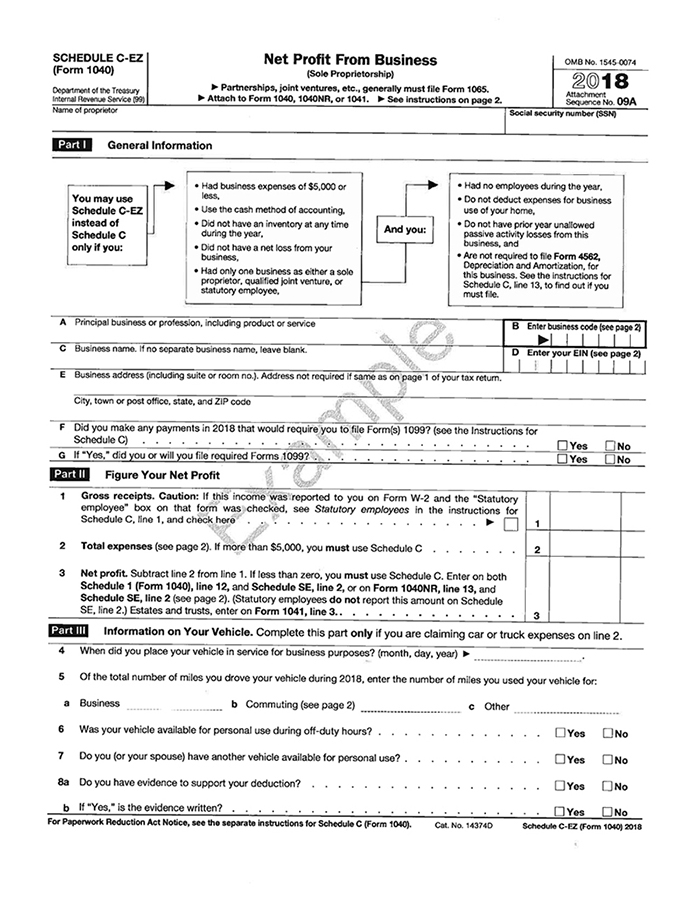

Labor Costs 15000 Product Costs. This form is known as a Profit or Loss from Business form. Tax return schedules are tax forms you complete in addition to your return when you file.

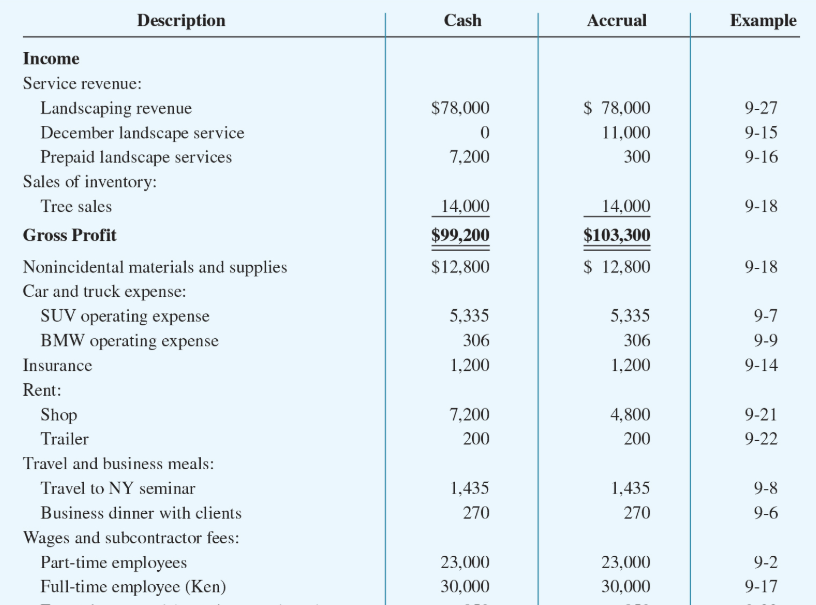

Gather Information Business income. Lines 3 5 and 7 can be taken as instructions but for the rest heres a quick translation. He uses the cash method of accounting and files his return on a calendar year basis.

If you have a loss check the box that describes your investment in this activity. The Two Columns of Schedule C. If you checked the box on line 1 see the line 31 instructions.

Select the document you want to sign and click Upload. Decide on what kind of. It is used by the United States Internal Revenue Service for.

Example of Income Schedule C Part II Expenses Advertising Car and truck expenses Commissions and fees Contract labor see instructions Depletion Depreciation and section. Schedule 1 Form 1040 or 1040-SR line 3 or. A Schedule C is a supplemental form that will be used with a Form 1040.

The best way to learn is with examples. 13 KB Download This form can be used by an organization to calculate its profit and losses in accordance with the tax. SCHEDULE C Form 1040 Department of the Treasury Internal Revenue Service 99 Profit or Loss From Business Sole Proprietorship Go to wwwirsgovScheduleC for instructions and.

Follow the step-by-step instructions below to design your 2015 schedule c tax form. Form 1041 line 3. If a loss you.

Estates and trusts enter on. Use Form 8995 to determine if you qualify and the amount of your deduction. Form 1040-NR line 13 and on.

Youll need detailed information about the sources of your business income. The resulting profit or loss is typically. The first column is entitled Functional Currency.

Schedule SE line 2. The QBI deduction is separate from Schedule C. If you checked 32a enter the.

If you use tax software to file a Schedule C it. Go to line 32 31 32. Sample Schedule C Tax Form taxwvgov Details File Format PDF Size.

If you are completing the Form 5471 on behalf of.

Schedule C Instructions With Faqs

/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

Schedule F Form Profit Or Loss From Farming Definition

When Do I Need To Worry About Taxes For My Shop The Hobby Vs Business Myth Paper Spark

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

Free 9 Sample Schedule C Forms In Pdf Ms Word

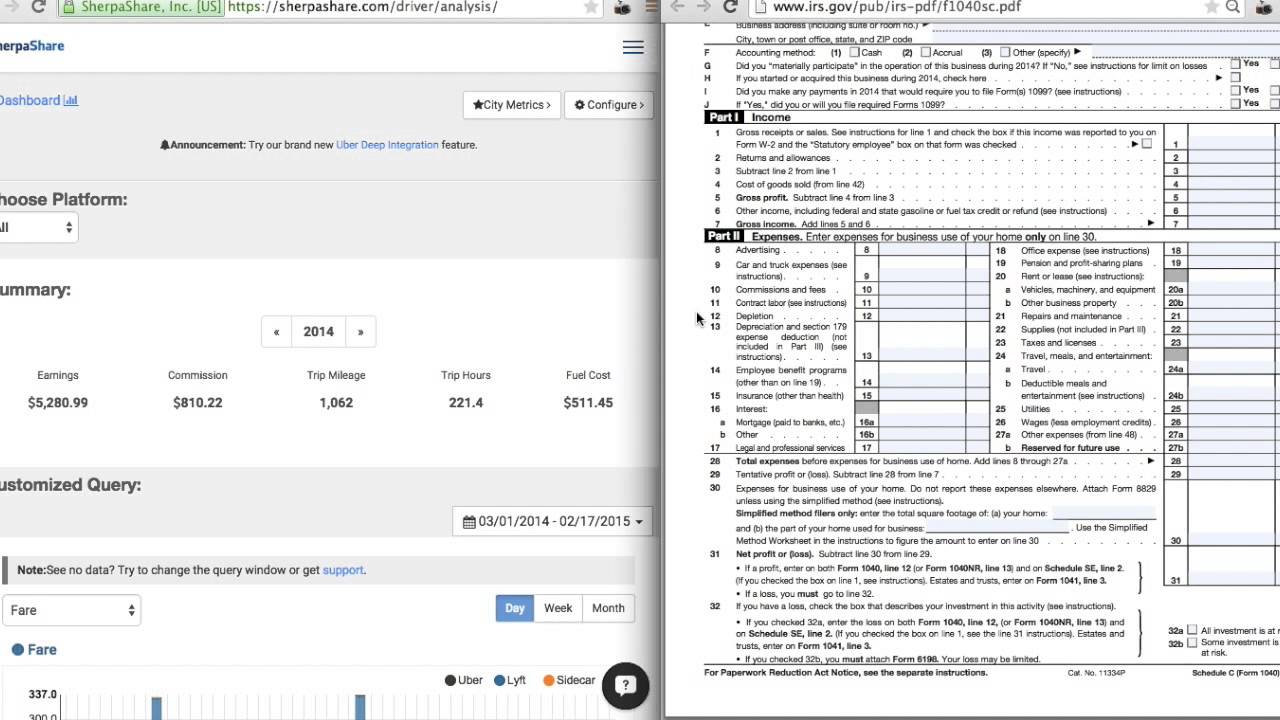

Filing Your Uber Lyft And Sidecar Rideshare Taxes With Sherpashare Data Youtube

How To Fill Out Your Schedule C Perfectly With Examples

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet Tax Forms Irs Forms Irs Tax Forms

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business

Tax Return Forms Schedules Smith College

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

The Go Curry Cracker 2016 Business Taxes Go Curry Cracker

Free 9 Sample Schedule C Forms In Pdf Ms Word

Tax Deductions The Ebay Community

Publication 334 Tax Guide For Small Business Preparing The Return For Stanley Price

How To Fill Out Your 2021 Schedule C With Example

Solved Schedule C Form 1040 Profit Or Loss From Business Chegg Com