2022 tax return calculator canada

The 2022 Tax Calculator includes Federal and Province tax calculations for all income expense and tax credit scenarios. Calculate the tax savings.

Tax Calculator Return Refund Estimator 2022 2023 H R Block

For example in the 2021 tax season if you earn 80000 you will be in the 49020 to 98040 tax bracket with a tax rate of 205.

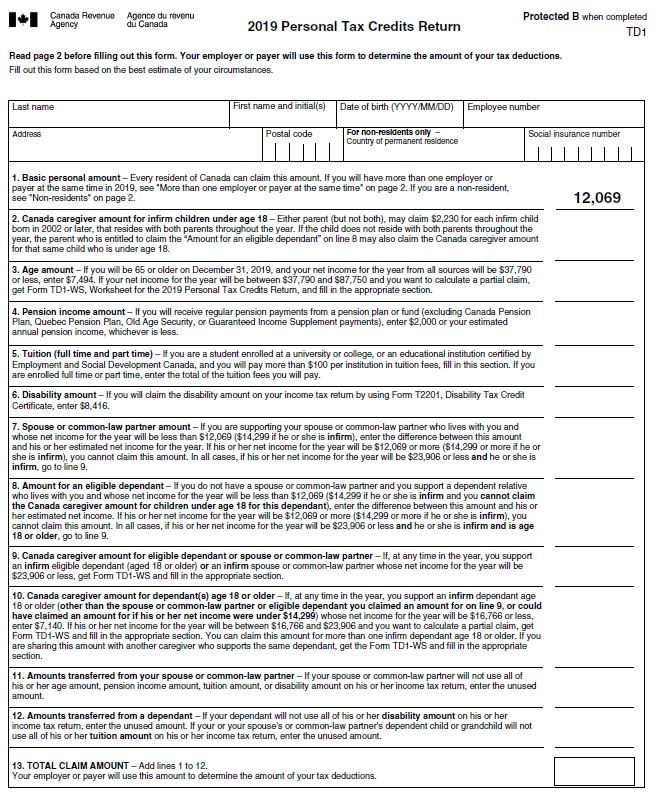

. 2022 Tax Return Calculator Canada. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. TurboTax free Canada income tax calculator for 2021 quickly estimates your federal and provincial taxes.

Youll get a rough estimate of how much youll get back or what youll owe. 205 on the next 50195 of taxable income on the portion of taxable income over 50197 up to 100392 plus. Ad We Are A 100 Virtual Operation And We Pass Those Savings To You In Fees.

Find out your tax refund or taxes owed plus federal and provincial tax rates. Read customer reviews find best sellers. Calculate the tax savings your RRSP contribution generates in each province and territory.

Calculate your combined federal and provincial tax bill in each province and territory. 2022 Personal tax calculator. FREE- Simple tax calculator to quickly estimate your Canadian Income Tax for 2022.

Thursday August 11 2022. Calculate your combined federal and provincial tax bill in each province and territory. Reflects known rates as of June 1 2022.

Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. That means that your net pay will be 40568 per year or 3381 per month. Personal tax calculator.

The canada tax calculator provides state and province tax return. 2022 tax return calculator canada. This means that you are taxed at 205 from.

Ad Calculate Your 2022 Tax Return 100. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. Assumes RRSP contribution amount is fully.

Use our free 2022 ontario income tax calculator to see how much you will pay in taxes. The calculator reflects known rates as of June 1 2022. Use our simple 2021 income tax calculator for an idea of what your return will look like this year.

See your tax bracket marginal and average tax rates payroll tax deductions tax refunds and taxes owed. Easily E-File to Claim Your Max Refund Guaranteed. Calculations are based on rates known as of June 17 2022 including federal and provincialterritorial tax changes known at this time.

It all adds up to The New. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Updated for 2022 the Canada Tax Return Calculator is a complex yet.

We are a community of solvers combining human ingenuity experience and technology innovation to deliver sustained outcomes and build trust. Ad Browse discover thousands of brands. This calculator is for 2022 Tax Returns due in 2023.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Our Accounting Services Offer Individuals Tax Preparation Services. Check how much taxes you need to pay on CERB CRSB CESB CRB and much more.

Estimate your provincial taxes with our free British Columbia income tax calculator. 2021 2022 tax brackets and most tax. Your average tax rate is.

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Do You Know How To Calculate After Tax Returns Russell Investments

Wyomingites Still Have Time To Apply For Property Tax Refund Program Sweetwaternow

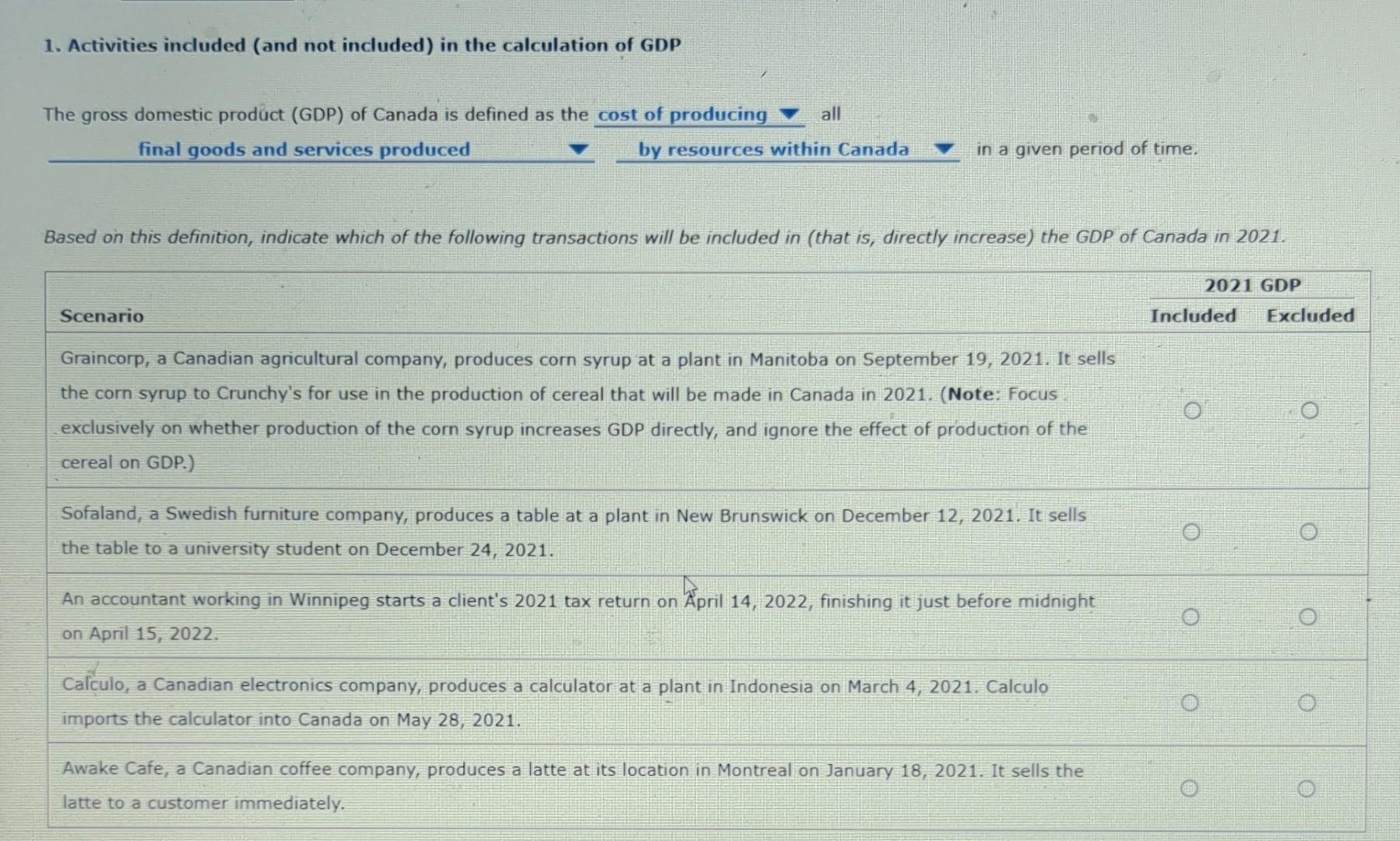

Solved 1 Activities Included And Not Included In The Chegg Com

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

Best Tax Return Softwares In Canada 2022 Greedyrates Ca

Canada Capital Gains Tax Calculator 2022

Free Tax Return Calculator Estimate Your Tax Refund Smartasset

Do I Need To File A Tax Return Forbes Advisor

U S Estate Tax For Canadians Manulife Investment Management

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

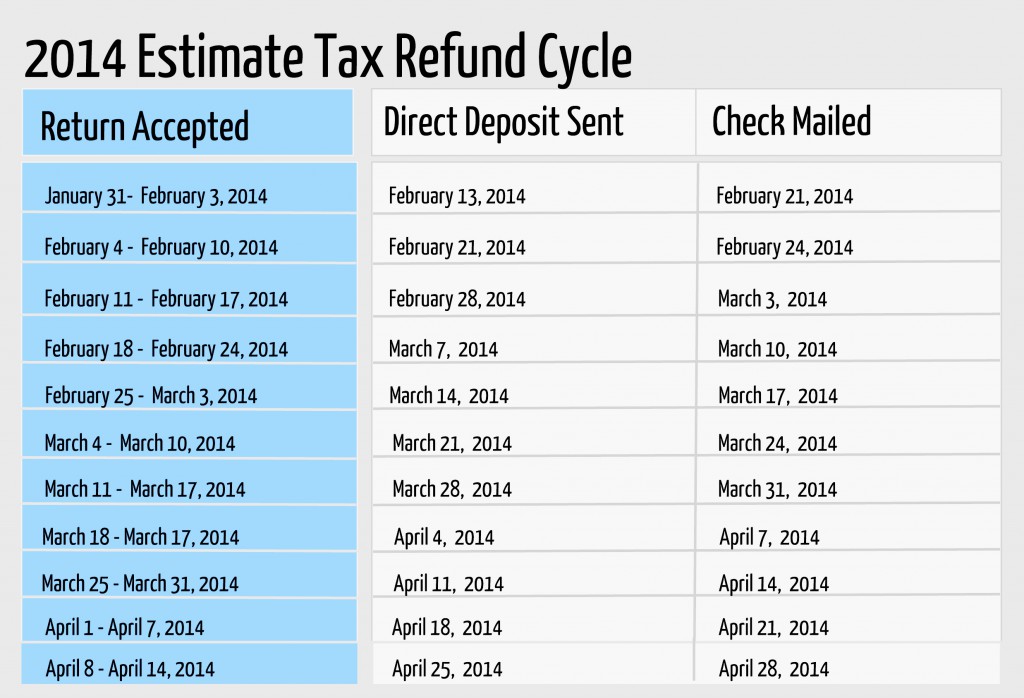

2014 Estimate Refund Cycle Chart Rapidtax Blog

H R Block Tax Calculator Free Refund Estimator 2022

Canadian Tax Return Faqs Study In Canada

Tax Season 2021 New Income Tax Rates Brackets And The Most Important Irs Forms